For the past 40 years, for some odd reason, I have been concerned about the high level of federal spending. I was raised by great mentors on a diet of sound fiscal management, control spending first, PAYGO, discretionary caps, Gramm-Rudman-Hollings, give the president line-item veto powers, “don’t waste one precious dollar from the average taxpayer!”

I was heavily indoctrinated in the belief that huge annual budget deficits led to (you name it): high interest rates, sky-high inflation rates, currency devaluation, crowding out of private-sector borrowing, financial destruction and, for all I knew, the heartbreak of psoriasis and eczema.

None of the predicted economic catastrophes ever happened. Inflation was 13.5% in 1980; prime interest rates hit 21% in June 1982.

Inflation is near zero today. So are real interest rates. We have violated every common-sense, rational, conservative balanced-budget principle and deficit-spent our way from $3.4 trillion in publicly-held debt in 2001 to $19 trillion today.

The national debt of $980 billion in 1980 represented over 30% of GDP. At $19 trillion of debt and still counting, it represents 86% of GDP today.

We were terrified of such rampant deficit-spending and fiscal irresponsibility when we graduated from college back then. The economy was stuck in “stagflation” — stagnant economic growth plus high inflation — the worst of both worlds. Stagflation was not entirely the fault of President Jimmy Carter, but his policies and those of the heavily Democratic-controlled Congress and Senate, plus the Federal Reserve between 1977 and 1981, we were told, surely exacerbated the severity of both.

To avoid more “stagflation,” unemployment and negligible prosperity going forward, Republicans acted like the conservatives they were back then and tried to hold the line on federal spending to balance the budget and stop adding exorbitant amounts of debt that we were convinced would lead to hyperinflation and sky-high interest rates.

It wasn’t until the second term of President Bill Clinton that America experienced four straight balanced budgets from 1998-2001 when a Republican Congress forced his hand to sign a welfare reform bill first and then the 1997 Balanced Budget Act.

Those were halcyon days for responsible common-sense folks. Dynasty sort of years comparable to four Final Fours and four national title banners. CBO predicted budget surpluses for as far as the eye could see in 2000; Social Security would be solvent for 100 years, and life would be perfect in America.

And then, 9/11 hit. And then the Bush tax cuts. And then the Greatest Recession since the 1930. And then Obamacare.

And now this Coronavirus-induced economic plunge off the cliff and government budget-busting without precedent outside of world war. Thirty million Americans were not just laid-off but thrown out of the work door literally overnight.

As in every crisis in the past, supply-side theorists from the right extol tax cuts, and Keynesians from the left extol the virtues of massive spending to solve all our problems. Monetarists say “expand the Federal Reserve balance sheet” with abandon to provide liquidity to the banking system, which is all done outside of the “official” national debt totals that keep going through the roof.

Budget deficits first exceeded $1 trillion in 2008 under Bush 43. President Obama presided over four straight trillion-dollar deficits in his first term. The federal deficit this year alone will be close to $3.7 trillion, and we are barely in the fourth inning.

Why haven’t interest rates exploded to 21% at any time since 1982? Why hasn’t inflation exploded to 13.5% like in 1980? If nothing bad is going to happen, let’s cut everyone’s taxes to near zero, spend $100 trillion and give everyone free healthcare and education — filet mignon and caviar in every kitchen and a Rolls-Royce in every garage.

Maybe Paul Krugman is right. Maybe we really can deficit-spend the heck out of anything in America.

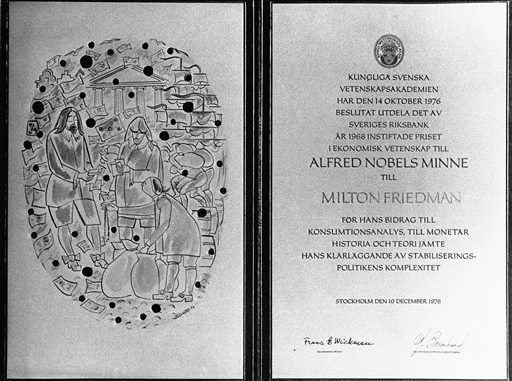

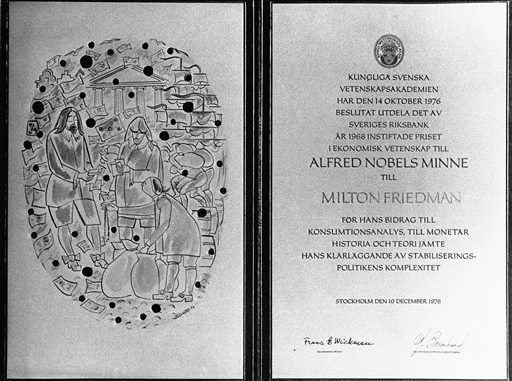

Poor Milton Friedman. If he were cremated instead of being laid to rest, then his dust molecules must be bouncing around like Mexican jumping beans, because none of his warnings have come true.

Yet, that is.